Table of contents

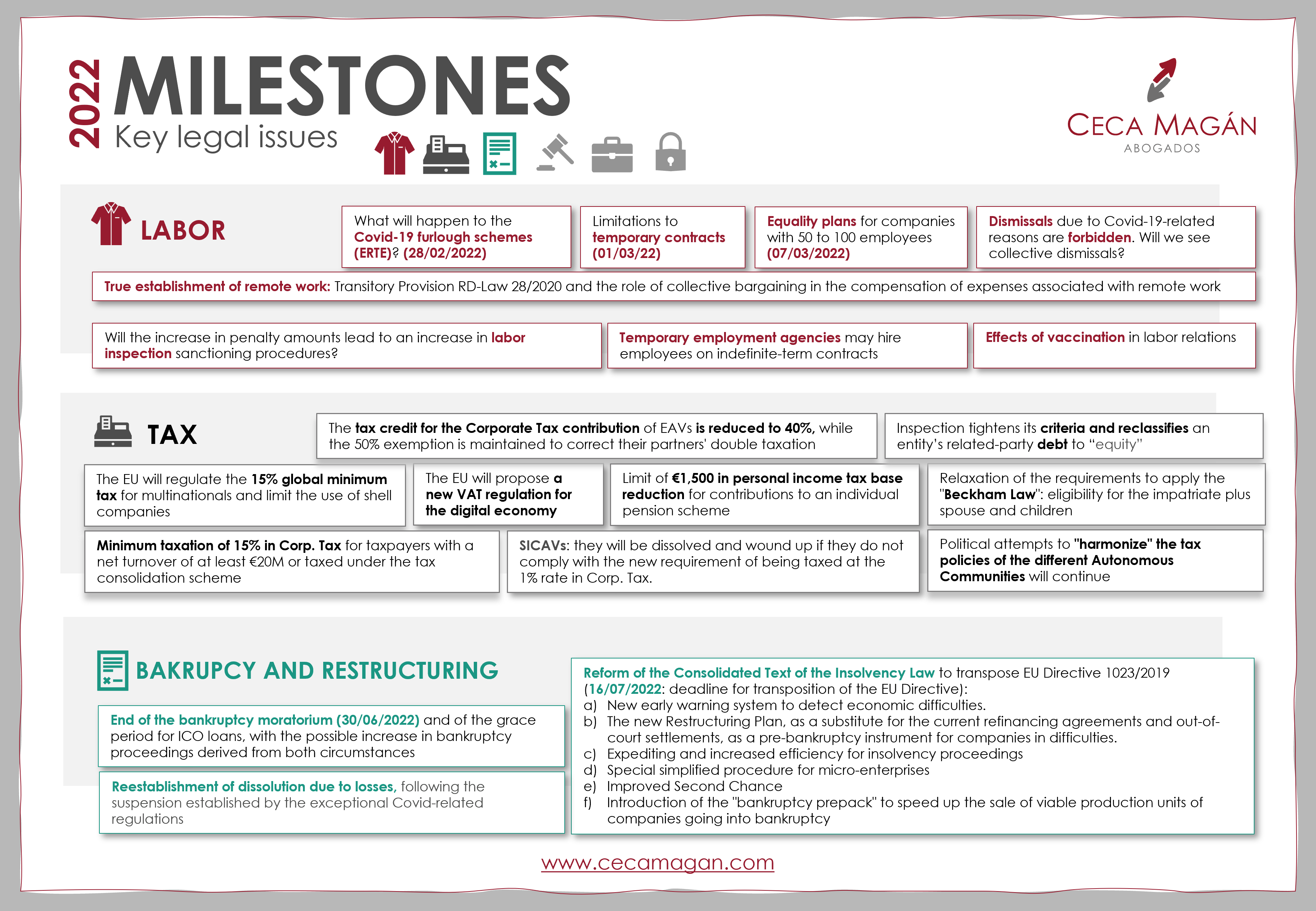

- LABOR LAW: a new labor reform

- TAX LAW: changes imposed by the EU and increase in litigation

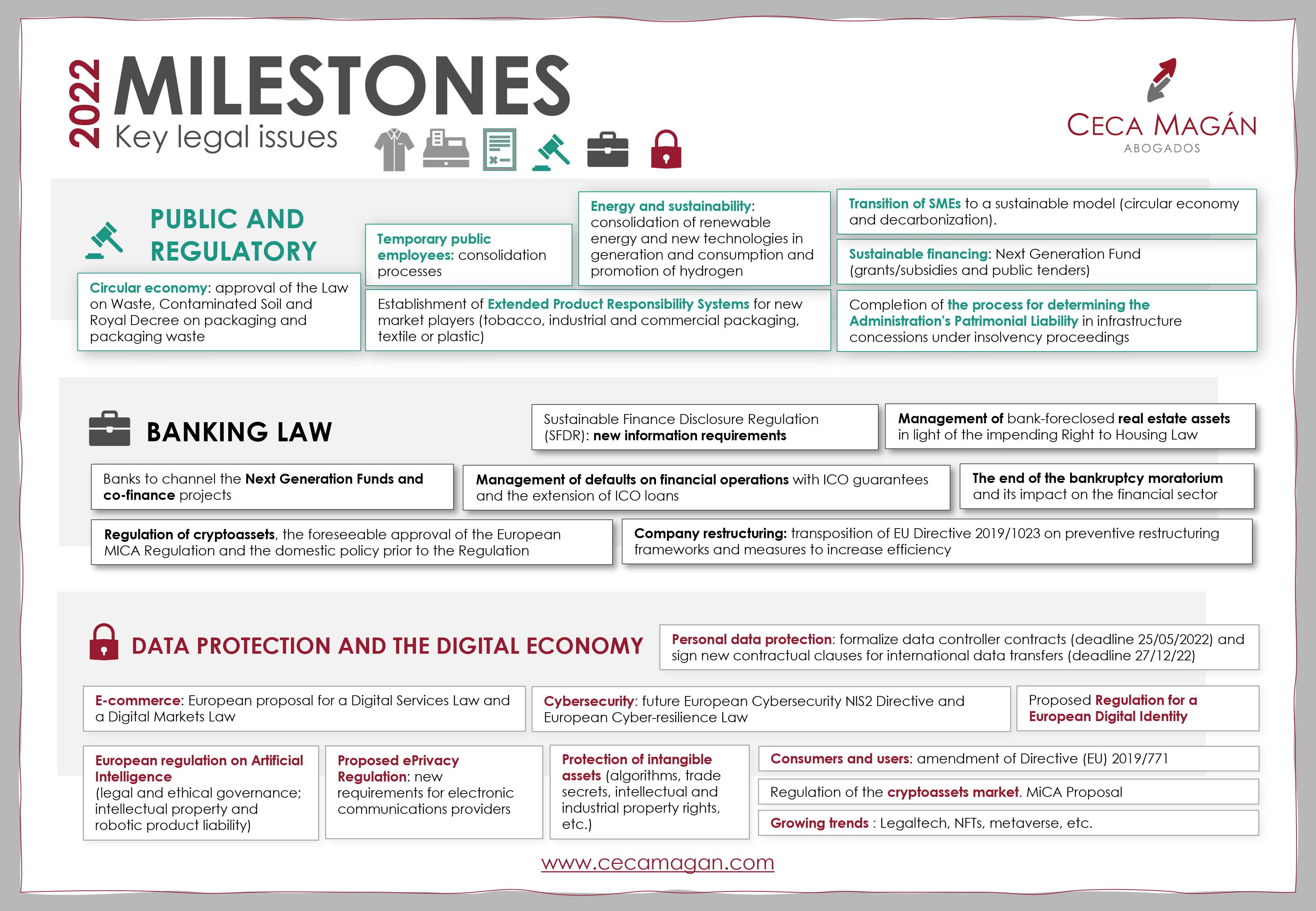

- PUBLIC AND REGULATORY LAW: public administrations and sustainability

- TECHNOLOGY, INNOVATION AND THE DIGITAL ECONOMY: digital assets and data protection

- BANKING AND FINANCE LAW: SFDR regulation and restructurings

- BANKRUPTCY AND RESTRUCTURING: end of moratorium and Bankruptcy Law

- COMMERCIAL LAW: corporate protection, Startups and investments

The year 2022 starts with many legal changes and milestones that affect different areas of law.

Any regulatory change implies legal certainty for all social agents: companies, employers and workers. It is yet to be seen whether all these milestones will actually materialize and how they might affect the different activities.

In any case, this article includes the main opinions and key legal issues for 2022 from our senior lawyers and partners in the areas of labor, tax, public-regulatory, data protection and digital law, banking law, bankruptcy law and commercial law.

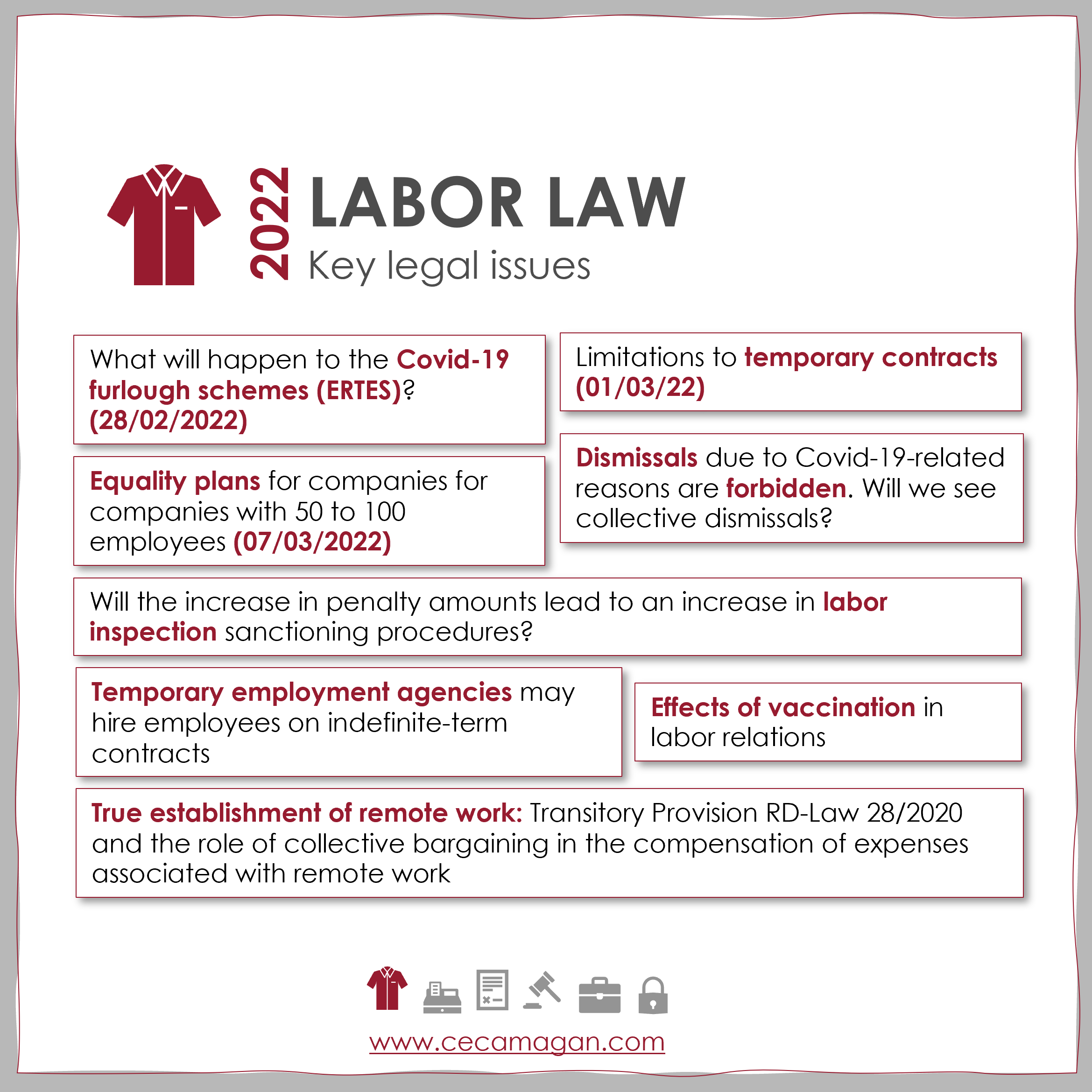

LABOR LAW: a new labor reform

Our managing partner in the labor department, Enrique Ceca, makes the following assessment and forecasts for the coming year in the labor law field:

“We ended 2021 with the anticipated labor reform, whose effects will take place in 2022. All of this coupled with the effects of the pandemic in labor relations, especially regarding dismissals not being allowed, in particular in those companies that are not going to recover pre-covid19 activity levels in the short or medium term.

Finally, the latest regulatory changes will continue to show relevant consequences, especially in matters such as remote work, the increase in labor sanctions, and the measures aimed at guaranteeing equality in companies, which are becoming increasingly more important and impacting the Spanish business fabric, including those with more than 50 employees".

The 8 key legal issues expected in 2022 are:

- What will happen to the Covid-19 furlough schemes (ERTES)? (28/02/2022)

- Limitations to temporary contracts (01/03/22)

- Equality plans for companies with 50 to 100 employees (07/03/2022)

- Dismissals due to Covid-19-related reasons are forbidden. Will we see collective dismissals? (throughout 2022)

- Will the increase in penalty amounts lead to an increase in labor inspection sanctioning procedures? (throughout 2022)

- True establishment of remote work: Transitory Provision RD-Law 28/2020 and the role of collective bargaining in the compensation of expenses associated with remote work (throughout 2022)

- Temporary employment agencies may hire employees on indefinite-term contracts (throughout 2022)

- Effects of vaccination in labor relations (throughout 2022)

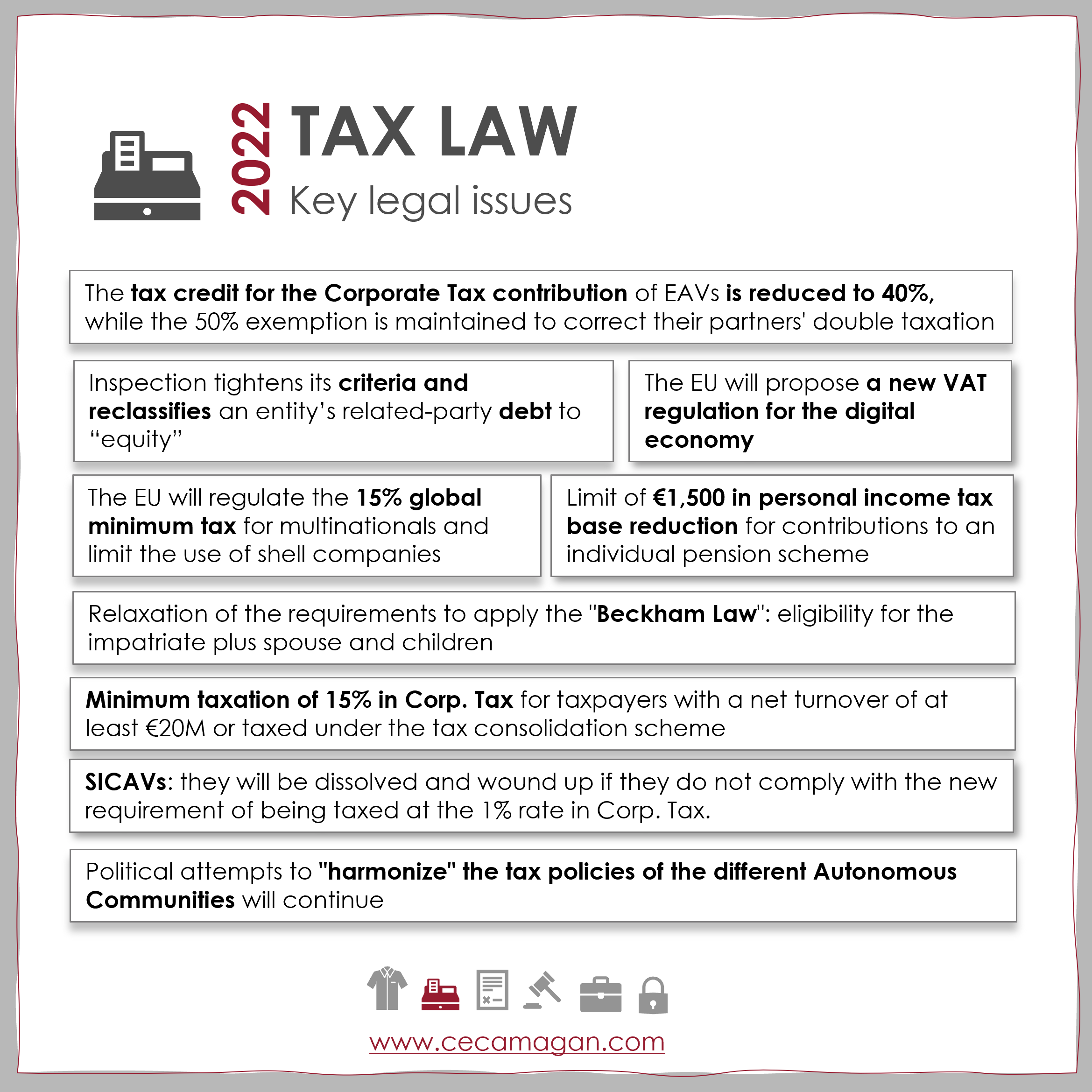

TAX LAW: changes imposed by the EU and increase in litigation

Paula Gámez, partner of the tax department, gives her assessment of the key dates for 2022 in the field of tax law:

“In addition to the latest tax changes approved in the General State Budget Law - such as the minimum Corporate Tax rate -, this year will be marked by the new criteria imposed from the EU and, mainly, by a significant increase in litigation.

It is foreseeable that the new reference values for real estate, the new regulation of the Tax on the Increase in Value of Urban Land (IIVT), and the tightening of the criteria applied by the inspection will cause an increase in litigation. In addition, we will see how the abbreviated verification procedures are massively used by our Tax Agency.

Finally, we can’t rule out additional tax reforms in addition to those already planned since the group of experts who are currently addressing the tax reform planned by the Government for next year are expected to deliver their conclusions before February 28, 2022, and these are likely to include harsher Wealth Tax and Donations and Inheritance Tax -taxes that they want to harmonize nationwide. In any case, given that the next general elections are scheduled for 2023, there will be an almost pre-electoral environment which could make it difficult to pass far-reaching reforms."

These are the 9 key milestones for 2022 in the Tax Law field:

- The EU will regulate the 15% global minimum tax for multinationals and limit the use of shell companies.

- The EU will propose a new VAT regulation for the digital economy -which will mainly affect digital platforms- and the rules regarding reduced tax rates will be updated.

- Minimum taxation of 15% in Corp. Tax for taxpayers with a net turnover of at least €20M or taxed under the tax consolidation scheme.

- The tax credit for the Corporate Tax contribution of EAVs is reduced to 40%, while the 50% exemption is maintained to correct their partners' double taxation.

- Limit set at €1,500 in personal income tax base reduction for contributions to an individual pension scheme and the incentive for employment plans is reinforced.

- It is foreseeable that the requirements to apply the "Beckham Law" will be more flexible: the impatriate plus his/her spouse and children will be eligible.

- SICAVs: they will be dissolved and wound up if they do not comply with the new requirement of being taxed at the 1% Corp. Tax rate (the transitory scheme established for this purpose)

- The political attempts to "harmonize" the tax policies of the different Autonomous Communities will continue.

- Inspection tightens its criteria and reclassifies an entity’s related-party debt to “equity”.

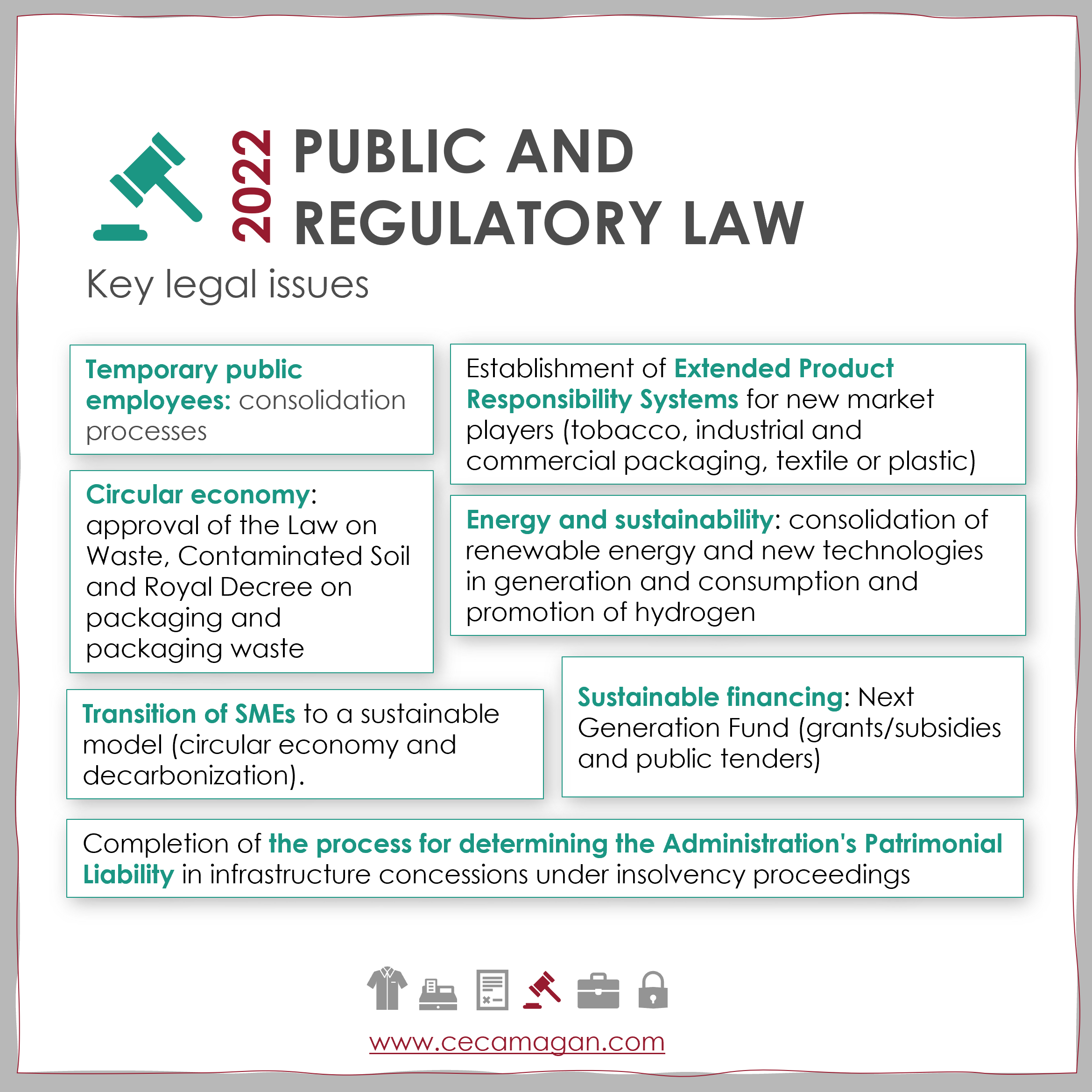

PUBLIC AND REGULATORY LAW: public administrations and sustainability

The partners of the department, María José Rovira and Rafael Ariño, share their views on Public and Regulatory Law and the Public Administration for this year:

“The CJEU doctrine on the scandal of the very high rate of temporary contracts for public jobs is transforming the hiring mechanism of Public Administrations and Public Bodies. The recent Law 20/2021 of December 28th aimed at reducing the temporary nature of public employment marks the beginning of the largest public employment consolidation process ever known, which will lead to conflicts not only in relation to access to permanent employment, but also to specific jobs.

On the other hand, the legal sector has the opportunity of accompanying industrial, commercial and energy companies in the design and implementation of sustainable production, distribution and consumption models.

Regulatory initiatives in areas such as waste, soil, air emissions, water use, renewable energies, energy efficiency or environmental taxation are leading to changes in processes and structures.

Having detailed knowledge of regulations and being able to access the different financing instruments initiated through the Next Generation Funds are key to being able to adapt to these changes.

Lastly, at the beginning of 2022, the Supreme Court rulings on toll road concessions under bankruptcy proceedings (the most important infrastructure-related issue in quantitative terms, with more than € 5 billion under litigation) will be notified. The Supreme Court set December 2021 as the date for voting and ruling on the key lawsuits, which will interpret the Council of Ministers Agreement to determine the amount of compensation to be paid by the State”.

The following are the 7 key milestones in Public and Regulatory Law to be taken into account:

- Temporary public employees: consolidation processes

- Circular economy: the approval of the Law on Waste, Contaminated Soil and the Royal Decree on packaging and packaging waste, among others, is expected in 2022.

- The above will lead to the establishment of Extended Product Responsibility Systems for new market players (tobacco, industrial and commercial packaging, textile or plastic products).

- Energy policy and sustainability: consolidation of renewable energy and new technologies in generation and consumption and promotion of hydrogen.

- Sustainable financing: Next Generation Fund (grants/subsidies and public tenders).

- Transition of SMEs to a sustainable model (circular economy and decarbonization).

- Completion of the process for determining the Administration's Patrimonial Liability in infrastructure concessions under insolvency proceedings.

TECHNOLOGY, INNOVATION AND THE DIGITAL ECONOMY: digital assets and data protection

Our partner in this department, Ramón Mesonero-Romanos, makes the following forecasts for Digital Law in 2022:

“There is no doubt that, over the last few years, public and private organizations have invested in digitization and digital transformation as a cornerstone for growth and also to ensure survival and continuity of services in the wake of the global pandemic we have endured. This trend will continue throughout 2022 in all sectors.

That is why in the digital era in which we are immersed, progress will have to be made in digital services (online platforms), in the use of artificial intelligence in the different corporate processes (customer management, HR, etc.), in the use of data and in improving cybersecurity.

Likewise, investment in tools for Legaltech, NFT and the protection of intangible assets in companies is becoming more and more important, resulting in a competitive element. In short, the legal approval or design of any initiative with an impact on the digital field will be crucial, not only to avoid penalties for legal non-compliance, but also as a competitive and differentiating factor in the market”.

The 10 key legal dates for the technological field in 2022 are:

- Personal data protection:

- formalize data controller contracts previous to the GDPR (deadline 25/05/2022)

- sign new contractual clauses for international data transfers (deadline 27/12/22)

- European regulation on Artificial Intelligence: (legal and ethical governance; intellectual property and robotic product liability).

- E-commerce: European proposal for a Digital Services Act and a Digital Markets Act.

- Consumers and users: amendment of Directive (EU) 2019/771.

- Cybersecurity: future European Cybersecurity NIS2 Directive and European Cyber-resilience Law

- Proposed ePrivacy Regulation: new requirements for electronic communications providers.

- Regulation of the cryptoassets market. MiCA Proposal.

- Proposed REGULATION for a European Digital Identity.

- Protection of intangible assets (algorithms, trade secrets, intellectual and industrial property rights, etc.)

- Growing trends: Legaltech, NFTs, metaverse, etc.

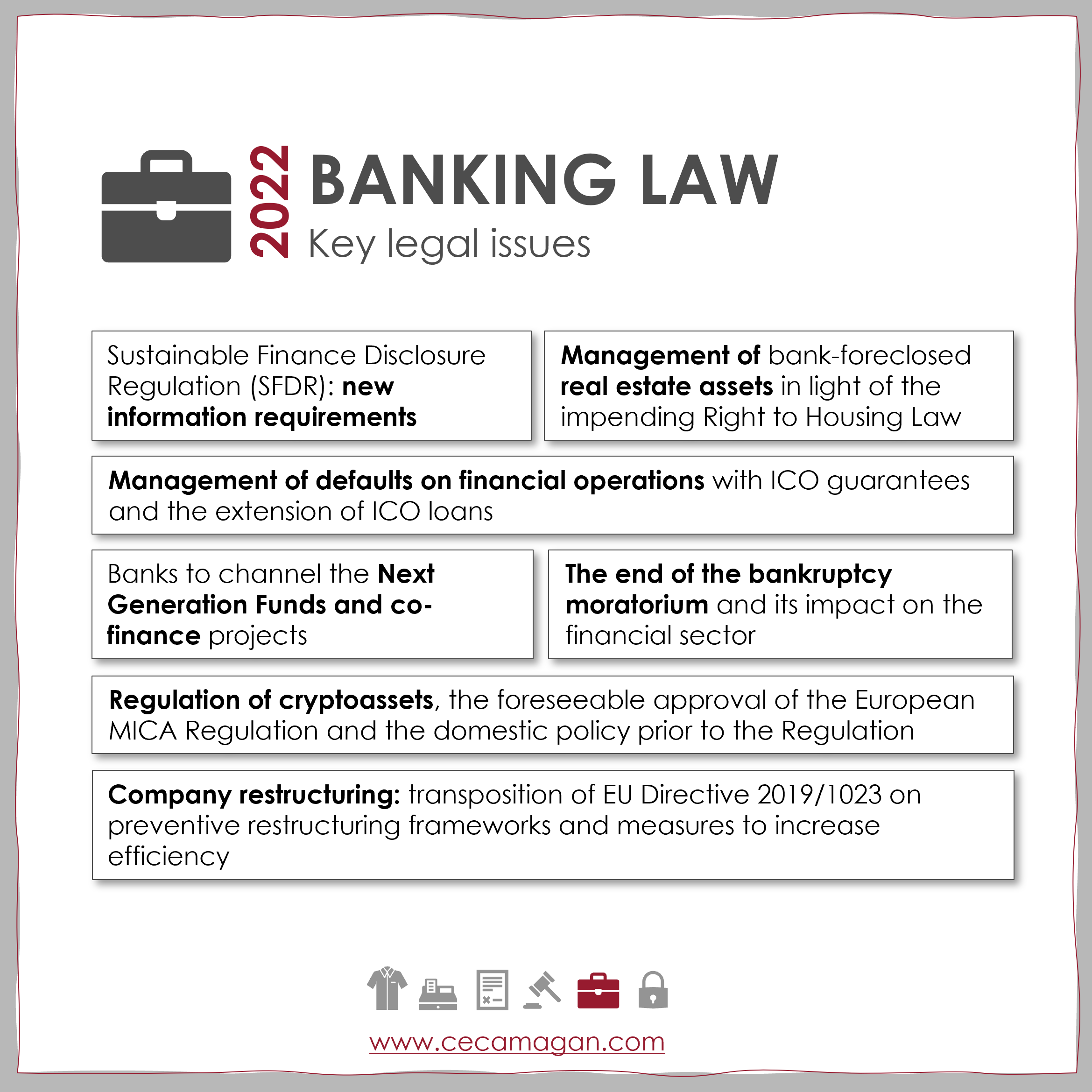

BANKING AND FINANCE LAW: SFDR regulation and restructurings

José Ramón Couso, partner in the banking department, offers the following forecasts for this field in 2022:

“If during 2020 and 2021 the banking sector proved its strength by responding quickly to the new COVID framework (moratoriums, ICO, etc.), 2022 will be full of challenges and legislative requirements for banks.

The full entry into force of the SFDR Regulation is a new step in sustainable financing and the Banking sector is a decisive instrument in this business transformation. Similarly, the transposition of Directive 1023/2019 (Bankruptcy Law Reform) will turn restructuring into the standard way in which banks will address and channel situations of potential, imminent or current insolvency of companies.

Banking is a necessary channel for the financing of projects submitted by companies to access European Next Generation funds, and 2022 will be a decisive year. Another challenge for banks in 2022 will be the management of defaults on maturing ICO transactions and the end of the bankruptcy moratorium, for which their restructuring and recovery teams will have to lean on experts in the new regulatory framework.

Finally, two announced innovative regulations: crypto-assets and housing, which will undoubtedly affect the financial and banking sector”.

The 7 key legal dates for banking and finance law in 2022 are:

- Entry into forcé of the Sustainable Finance Disclosure Regulation (SFDR) (01/01/2022): new information requirements.

- Management of real estate assets foreclosed by banks, purchased by Funds or managed by Servicers, in light of the impending Right to Housing Law (30/03/2022).

- Company restructuring: transposition of EU Directive 2019/1023 on preventive restructuring frameworks (…) and measures to increase the efficiency of restructuring, insolvency and debt waiver proceedings (second half 2022).

- Banks to channel the Next Generation Funds and co-finance projects.

- Management of defaults on financial operations with ICO guarantees and the extension of ICO loans (30/06/2022).

- The end of the bankruptcy moratorium and its impact on the financial sector (estimated in 30/06/2022).

- Regulation of cryptoassets, the foreseeable approval of the European MICA Regulation and the domestic policy prior to the Regulation (first half of 2022).

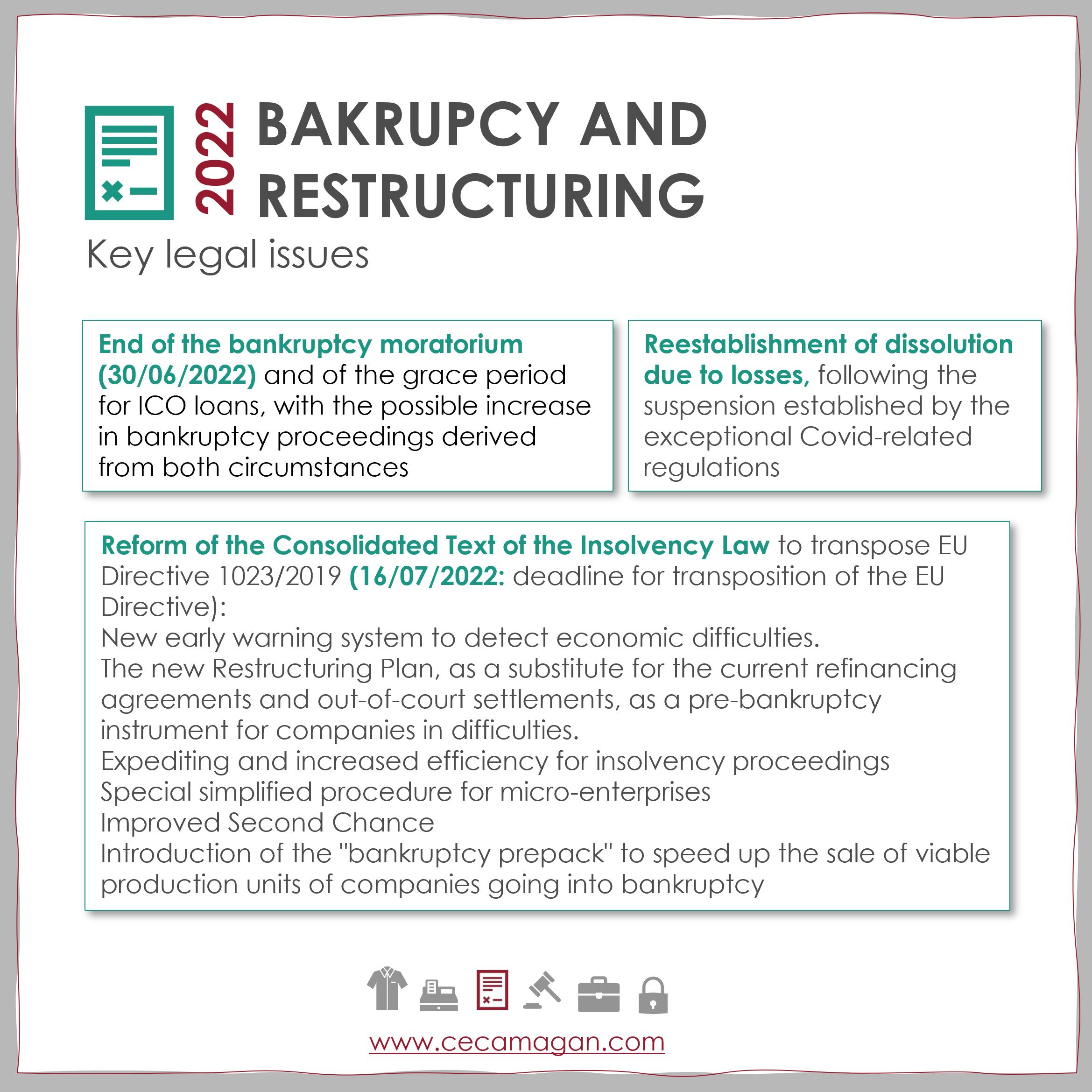

BANKRUPTCY AND RESTRUCTURING: end of moratorium and Bankruptcy Law

Jose Carlos González, managing partner of the bankruptcy and restructuring department, makes his forecasts for 2022 in this legal field:

“The foreseeable coincidence of the end of the bankruptcy moratorium with the entry into force of the Draft Law that was just approved by the Council of Ministers on December 21, 2021, with a broad and extensive reform of the Consolidated Text of the Bankruptcy Law with the aim of adapting it to the European Directive on preventive restructuring frameworks and Second Chance scheme, and which will foreseeably take place in mid-2022, is going to imply major changes in the bankruptcy law landscape in Spain: will there be or will there not be a large increase in the number of bankruptcy proceedings with the subsequent collapse of the courts? Will the restructuring sector and the role of the "restructuring expert" develop exponentially as an effective alternative to bankruptcy proceedings? Will a Second Chance scheme that is respectful of the wording and spirit of the Directive finally be approved? These and other uncertainties, which will also depend to a large extent on the evolution of the economy at a national and international level, will become clearer during 2022, a year that may undoubtedly bring about a true shift in the paradigm of our bankruptcy and pre-bankruptcy law”.

The 3 key dates expected in 2022 are:

- End of the bankruptcy moratorium (30/06/2022) and of the grace period for ICO loans, with the possible increase in bankruptcy proceedings derived from both circumstances.

- Reform of the Consolidated Text of the Insolvency Law to transpose EU Directive 1023/2019 (16/07/2022: deadline for transposition of the EU Directive):

- New early warning system to detect economic difficulties.

- The new Restructuring Plan, as a substitute for the current refinancing agreements and out-of-court settlements, as a pre-bankruptcy instrument for companies in difficulties.

- Expediting and increased efficiency for insolvency proceedings

- Special simplified procedure for micro-enterprises

- Improved Second Chance

- Introduction of the "bankruptcy prepack" to speed up the sale of viable production units of companies going into bankruptcy

- Reestablishment of dissolution due to losses, following the suspension established by the exceptional Covid-related regulations

COMMERCIAL LAW: corporate protection, Startups and investments

Finally, Alejandro Alonso, partner in the commercial area, outlines what he believes will be the most important milestones for this year:

“This year will most likely continue to be marked by the measures that are still being taken to alleviate the still very present consequences of COVID-19. In the commercial field, this year we also expect to see several legislative developments aimed at boosting and better protecting entrepreneurial initiatives.

These include the regulatory framework for emerging companies, also known as the "Startup Law" (for which there is already a Draft Law that was recently adopted by the Government) and the Draft Law for the creation and growth of companies, also known as the "Create and Grow Law", an instrument that may also prove to be important both in the fight against default and in the use of alternative financing mechanisms, with special mention of venture capital.

In the area of foreign investments in Spain (and Spanish investments abroad), in 2022 we should take into account the impact of the RD Law 27/2021, of November 23, extending certain measures to support the recovery, in particular the measure to extend the suspension of the liberalization regime for certain foreign investments (the so-called "anti-takeover shield") until December 31, 2022, and to improve - by clarifying it - the procedure for the reporting of this type of investments.

It is also worth mentioning the much-needed transposition into our legislation of Directive 2019/1151, on the Digitalization of Companies, whose transposition deadline has already expired, and which, among many other things, should pave the way to enable citizens (and of course companies) to execute notarized documents without going to the notary's office, and all that this entails. In addition, it is worth noting the new Securities Market and Investment Services Law, which should be approved this year.

Finally, we will have to be extremely alert to the impact of the "new" reform of the Bankruptcy Law on the commercial ecosystem, especially with regard to anything that could affect the regulatory framework for the sale and purchase of companies (or productive units of companies) in a pre-bankruptcy or bankruptcy situation”.

Our experts from the different legal fields are at your disposal to assist you in any of these legal issues and to advise you throughout 2022, a year that is looking complex and in which many new regulations will be adopted. You may contact them here.

Add new comment